Looking Back, Looking Ahead – Market Review 2025 and Outlook 2026

After thirty-seven years as a financial advisor, I’ve learned that I can usually tell how investors are feeling just by watching the flow of phone calls and emails that come into our office. When markets are turbulent and account values start to slip, our switchboard lights up like a Christmas tree. But when people are making money, it can get so quiet that you could hear a pin drop.

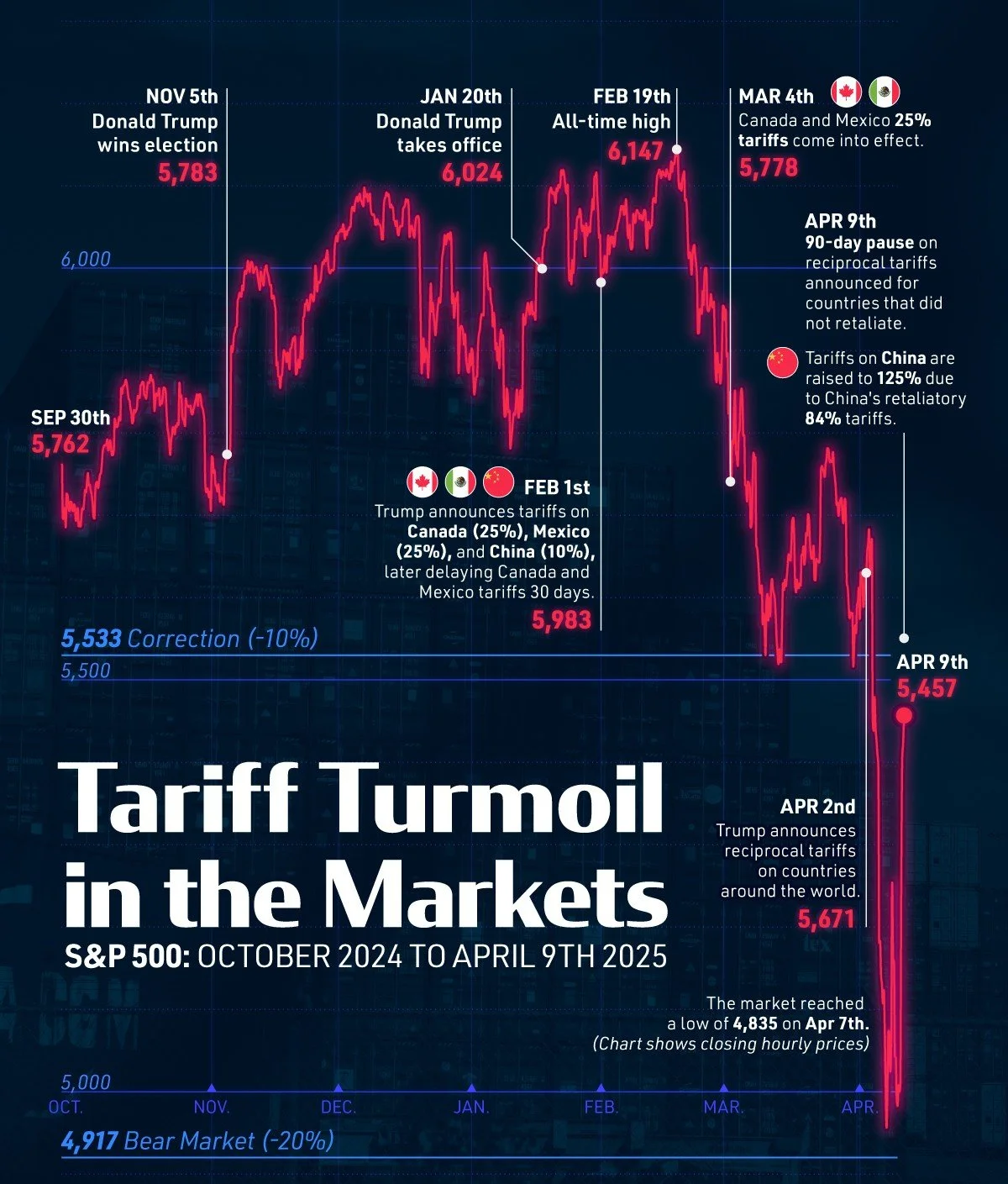

Back in March and April, when news of new tariffs and a falling stock market dominated the headlines, our phones were ringing constantly. Many of you were understandably concerned, and I’m proud of how our advisors stepped in to reassure clients that our portfolios held up extremely well—showing only small, short-term declines while the broader market dropped sharply.

Over the past few months, things have been much calmer. The call volume has been light, which usually tells me that most clients are feeling comfortable with both the markets and the economy. And that’s encouraging.

I also want to mention that, although we had some staffing changes in 2024, I can confidently say that our team today is the strongest it has ever been—and our portfolios remain resilient. We’ve sharpened our process, strengthened our research, and continued to refine the balance between opportunity and protection.

Even when things feel quiet, we’re not sitting still. My team and I are always researching, rebalancing, and monitoring your accounts to ensure everything stays aligned with your goals and with the current market environment.

So… what’s next?

As we close out 2025, I want to take a few minutes to look back at the year we’ve had and share how we’re positioned as we head into 2026.

At the end of 2024, valuations were high. Stocks had run well ahead of earnings, fueled by enthusiasm for artificial intelligence. So, we made a deliberate choice to rebalance portfolios—locking in gains, trimming positions that had grown large, and adding ballast for stability.

That decision was about active management—protecting what we’d built and preparing for what might come next.

Source: "Charted: The S&P 500’s Trump-Driven Tariff Turbulence," Visual Capitalist, April 10, 2025, https://www.visualcapitalist.com/charted-the-sp-500s-trump-driven-tariff-turbulence

Heading into this year, I expected a rocky environment—I put the odds of a downturn at about fifty-fifty. Then came the tariff announcement in April. Markets dropped quickly, with most equities falling between 10% and 20% in just a few weeks.

It caused plenty of concern—but our portfolios held up well. The alternative investments we added in 2024—gold, precious metals, international stocks, commodities, and tactical trading strategies—did exactly what they were designed to do: provide stability when traditional assets stumble.

In hindsight, the tariffs themselves had little lasting effect on the broader economy or on the market. The fear was greater than the fallout.

Source: https://www.google.com/finance/beta/quote/.INX:INDEXSP?window=YTD

What surprised many investors was how quickly the economy regained its footing.

Companies adapted. Supply chains shifted. Consumers kept spending. And the S&P 500 and other indexes rebounded nicely.

Even more encouraging, worker productivity surged, largely due to advances in artificial intelligence and automation. Businesses became more efficient, margins improved, and corporate profits strengthened.

Inflation softened throughout the year, giving the Federal Reserve room to begin cutting interest rates. Those rate cuts—combined with better earnings—sparked a wave of optimism that has carried the market higher through the fall.

Now, it wasn’t a straight line up. We saw significant sector rotation. Energy and health care led early in the year; technology stumbled mid-year; utilities and AI-related infrastructure names surged later on.

But through it all, one theme held true: balance and adaptability matter most.

The portfolios that weathered the volatility were the ones diversified across asset classes, geographies, and strategies.

So, what’s next?

Looking into 2026, I expect continued moderate growth in the markets. Global forecasts call for steady—if unspectacular—economic expansion, easing inflation, and supportive central-bank policy.

We just completed a comprehensive rebalancing across all of our accounts. This ensures your portfolios align with both your personal risk tolerance and our current view of market fundamentals.

Our approach remains the same: maintain a broadly diversified allocation, blending index-driven exposure with active management and alternatives. Each piece serves a purpose—some zig when others zag—creating a portfolio that can participate in growth while staying resilient when volatility returns.

Like a well-designed flower garden with plants blooming every season, our portfolios have blossomed beautifully and should continue to do so in the coming economic environment.

In short, we began this year preparing for turbulence—and we’re finishing it on solid ground.

The choices we made together—to rebalance, diversify, and stay disciplined—proved their worth.

As we enter 2026, I remain cautiously optimistic. The world is still complex, but opportunity always exists for those who stay thoughtful and patient.

Thank you for your trust and partnership this year.

Let’s look ahead with confidence and continue stewarding your wealth—wisely, intentionally, and with purpose.