Don Simmons has been a passionate impact investor for most of his career, coaching and mentoring businesses that alleviate poverty, create jobs, and bring flourishing to communities in need. For Don and our team, investing has never been just about financial returns—it’s about stewardship, purpose, and measurable impact. We believe that capital can be a powerful force for good when intentionally directed toward enterprises that uplift people and protect creation.

Impact investing is the practice of aligning your investments with your deeply held values—seeking positive environmental, social, and spiritual outcomes alongside financial returns. This can include supporting companies that care for the environment, uphold human rights, promote community development, and avoid industries or practices that are harmful or inconsistent with your beliefs. Our methodology is simple but effective: we avoid investments that do harm or contradict your values, embrace those that align with your convictions, and engage with companies through shareholder influence to encourage ethical and redemptive practices. It’s investing with both heart and mind—seeking not just returns, but restoration.

Isn’t it time that we started to care how profits are made, and not just how much profit is made? The ability to fully customize your investments used to be exclusively for the mega-wealthy. That’s not the case anymore. At Simmons Capital Group, we work together to help incorporate your values into your investment portfolio.

How it works:

1. Define your values

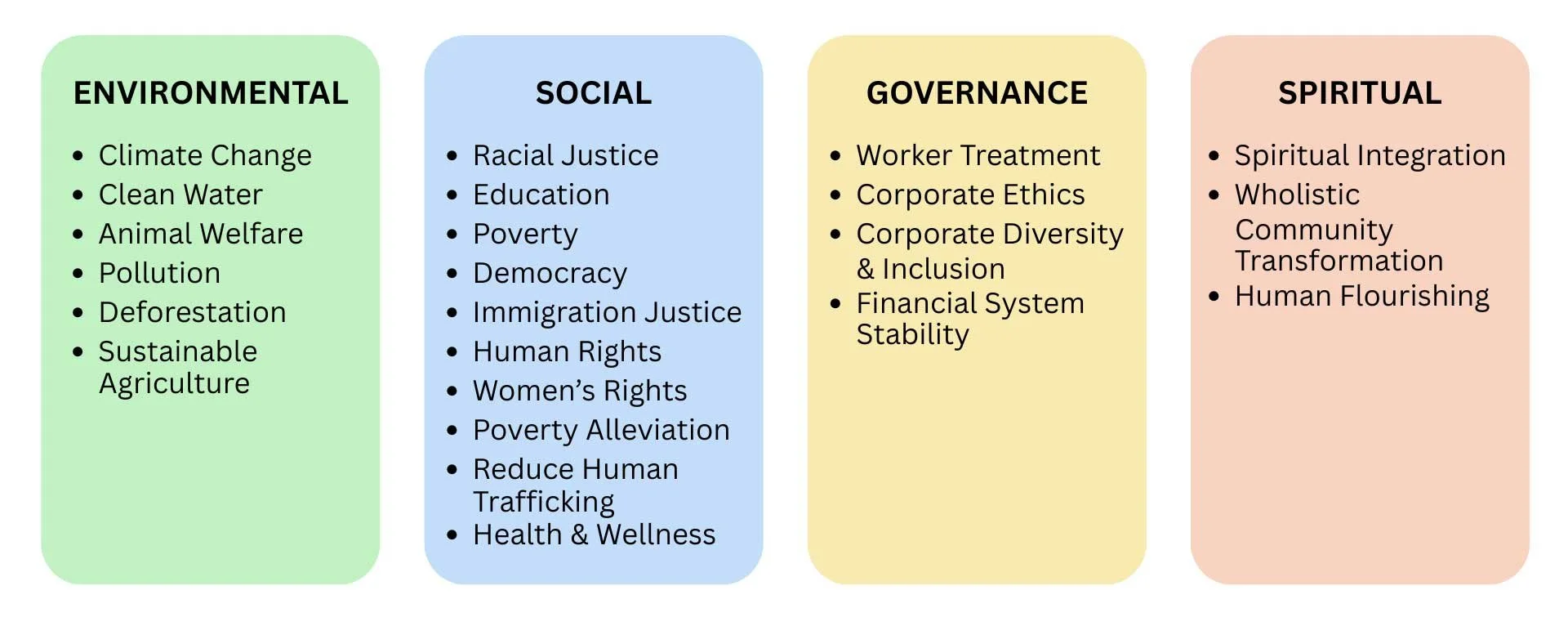

The first step towards investing impactfully is defining which issues you would like to focus on. Perhaps you're concerned about the environment, actively involved in your local community, or focused on purchasing responsibly sourced food and products. The values mapping exercise helps you create your personalized impact mission.

Customize your portfolio using these available pillars:

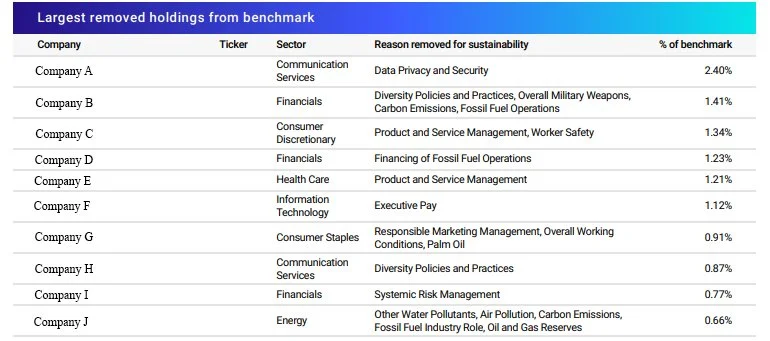

2. The Healthcheck

Now that you’ve determined which causes are most important to you, we run a Healthcheck to diagnose just how compatible your client investments are compared to your chosen pillars.

For example, if animals are important to you and Company X tests on animals, this Healthcheck gives you the insight you need to identify the problem company and take corrective action.

Source: Ethic

3. Rebalance

Once you know which securities are “clean,” meaning that they align with your impact preferences, we help you transition your investments into a portfolio that incorporates those securities and filters out those that don’t.

Source: Ethic

4. Measure your impact

As the saying goes, “money never sleeps”—and in this case, yours is actively working to make the world a better place. You will immediately see the impact your portfolio is creating. This reporting uses tangible examples to demonstrate how your portfolio is making a difference (e.g. gallons of water saved etc.).

Source: Ethic